Lemonade’s Loss Ratio: Why Insurance Carriers Should, and Shouldn’t, Be Worried…

Over the past few years, regardless of what your role in the insurance landscape has been, you’ve more than likely heard of Lemonade. Doesn’t matter if you believe they are the “Uber of Insurance” or a company destined to fail, Lemonade’s loss ratio and behavioral analytics strategy has been under the microscope for quite a while.

Now, in the past year, we’ve seen their stock price drop almost as quickly as it rose. To be fair, nearly every high-growth tech stock has faced similar destruction, but their stock performance is not what we are here to discuss.

We’re here to discuss disruption, and stale industries with entrenched players who fail to innovate will continually be disrupted by forward-thinking industry entrants.

We’ve seen it with cable, retail, transportation, you name it.

Monopolies make great investments until the competitive moat is breached. Failing to pay attention to the customer and instead focusing solely on the bottom line is why companies like Amazon, Netflix, and Uber have risen to fame.

But while traditional insurance Goliaths continue to dominate their respective industries and dismiss incoming threats, the Davids of the world quietly load up their slingshots.

Insurance carriers are currently asking themselves one question – has the pebble that could ultimately serve as the industry kill shot already been loosed?

Does Lemonade Insurance Have A Disruptive Business Model?

When your business model is inherently working against your customer’s best interests, there is an opportunity for disruption.

This notion dawned on Lemonade founders Daniel Schreiber and Shai Wininger when they examined the nuances of the insurance industry.

Doesn’t the very nature of the insurance business model create a conflict of interest between the company and its customers?

When a customer gives an insurance carrier money (premium) with the expectation that they’ll be protected in the event of an incident, they should feel safe.

But studies from both EY and Accenture indicate that many customers don’t trust their insurance to pay claims…why is that?

Well, much of the profits insurance carriers receive on a yearly basis is a result of their ability to invest the “float,” which is the premium received from clients but not paid out.

For example, if Company A collects $10 in premiums and only pays out $8, that $2 remaining goes straight to their bottom line, in addition to any profit they make by investing that $10 before claims are paid out. Carriers have been traditionally valued based on their ‘loss ratio’ or the ratio of claims paid by the carrier divided by the premiums they earned. In this case $8/$10 = 80%. (Note: anything under 100% is considered profitable).

The very nature of this business model is where the conflict of interest lies. Every dollar an insurance carrier does NOT payout, they get to keep as profit.

In other words, the more claims they reject, the more money they make, often resulting in lots of paperwork, scrutiny, policy manipulation and delayed (or rejected) payouts for claims.

The Uber of Insurance?

Dan and Shai thought, “what if we start a new insurance company that doesn’t have that conflict of interest? Customers will switch to a product they can trust.” And with that, they decided to combine their technical expertise and insurance naivety to create Lemonade.

Given a blank slate (or a literal whiteboard) – they thought “Let’s target the next wave of first-time insurance buyers…millennials and Gen Z and their current Renter’s and soon-to-be Homeowner’s policies.”

Now, if you were charged with creating a business to attract millennial buyers in an industry that hasn’t been upgraded in years – where would you start?

Probably by following in Uber’s footsteps and changing the whole business model…

I took some creative liberties here but I imagine the thought process went something like this…

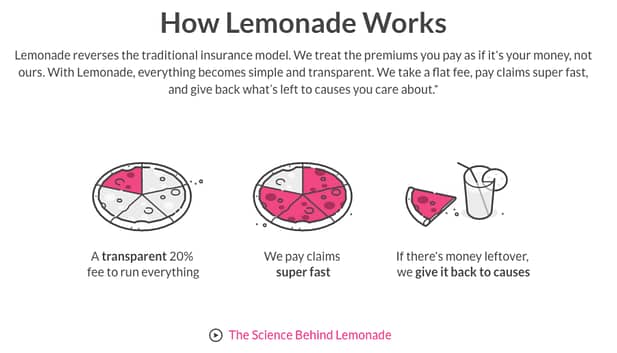

1. Let’s give our customers upfront and transparent pricing. We will charge them a simple transaction fee and eliminate the customer <> carrier conflict by donating any leftover funds to a charity of their choice. Millennials love social causes, and I’d bet they’d be less likely to commit fraud if they’re ‘stealing’ from a charity, not some ‘greedy corporation.’

2. No phone calls. Millennials hate being on the phone, especially with salespeople. Let’s make it text-based. Better yet – let’s automate that and make everything run with Chatbots.

3, No paper, definitely no paper, where do you even find a fax machine these days? Guess we’re making it app-based.

4. Speaking of salespeople, let’s eliminate them altogether. Heck, even Uber hasn’t been able to do that yet. All that money saved will help us drastically reduce prices for customers, fend off more expensive incumbents, and eliminate the annoying minimums many traditional players put in place.

5. Since we’ll never actually see our customers, we’ll need to use predictive behavioral analytics. With behavioral intelligence, we’re able to measure their digital body language from the moment they begin engaging with our application process all the way through to filing a claim. That digital history will give us an incredible amount of data on our “digital customers” that we would never have been able to get in person. With this new data set, we can ensure we’re offering a world-class experience without sacrificing risk controls.

6. Instant gratification is big with this demographic, so let’s make everything from policy approval to claims payout as close to instant as possible. That means using artificial intelligence to automate underwriting & claims. As the world moves towards accelerated (automated) underwriting and straight-through claims processing, we’ll skate to where the puck is going and do that from day one.

7. Let’s obviously use artificial intelligence, machine learning, and predictive analytics throughout the entire process. For instance, with behavioral analytics, we’ll be able to analyze the user experience down to the keystroke, mouse hover, and correction so we can pinpoint exactly where customers are experiencing friction and dropping off. This will transform insurance applications from a necessary evil to a seamless application & claims customer experience.

In addition, if we use behavioral analytics to study the actions of our customers and correlate those actions to their eventual outcome, we’ll be able to start predicting their intent at the point of submission.

This will help significantly improve underwriting precision and premium pricing accuracy. If we can do that, we will lower claims costs by predicting and reducing risk and fraud.

Lemonade’s Insurance loss ratio improvement is a result of their continued behavioral analytics and automated underwriting strategy

The magic of Lemonade’s improving loss and the combined ratio is in combining big data and behavioral analytics to predict risks and quantify losses. By placing individual customers in a specific risk group they are able to quote the relevant premium on a much more granular level.

We’re seeing a similar thing happen in medicine with new prescription drugs being developed to target a much smaller subset of a previously grouped population. We discuss this more here, but to summarize, Lemonade’s loss ratio improvements are a result of its continued investment in its digital behavioral analytics strategy.

Their software has allowed them to collect thousands of additional data points on their customers, which their machine learning algorithms use to underwrite more accurately. With that, populations that were once grouped together can be broken up into smaller and smaller groups allowing for far more precise risk assessments.

Lemonade’s loss ratio has improved quite a bit since its inception.

As you can see with this particular group, what was once a single loss ratio ended up being three separate loss ratios with a difference of up to 3x…🤯

These groups of “uniform insurers” share similar risk behaviors and are compiled by AI algorithms that gather extensive customer data and monitor loss ratios. The more data accumulates, the more recursive risk patterns emerge enabling more precise assessments.

Lemonade’s Loss Ratio is improving, but are they really taking over the world?

If Insurance carriers are smart, they’ll look back at history and try to learn from other companies’ failures.

While the Taxi industry disruption was likely inevitable, had they taken the threat seriously and partnered with 3rd-party technology companies to add in features like Ratings, GPS hailing, ride tracking, and seamless payments – I’d be willing to bet they could have slowed Uber’s growth significantly.

For insurance companies, that strategy should be the same. There are a plethora of InsurTech companies built to support the growing customer and carrier demands. From automation to machine learning to behavioral data, carriers need to focus on what they’re good at and outsource the rest to companies that specialize in it.

And while Lemonade has the advantage of being a technology company that happens to sell insurance – all is not lost when it comes to playing catch up.

Lemonades’ loss ratio has almost halved from 166% to 86% between 2017 and 2019, was just north of 70% in Q1 2020, 91% in 2021, and has hovered around 90% in 2022, which has been a very difficult year for insurers.

“What we’re seeing here is something that is going to be very traumatic for the whole insurance space,’’ he says. “Data is overtaking expertise.”

“We’re getting smarter. Lemonade started at a data disadvantage, building up a data set from scratch and collecting information at every customer interaction. We knew it was only a matter of time before we were at a data advantage. If we’re not there yet, we sure are close. Interacting with our customers directly and digitally means we know them really well, even if we’ve never met them face-to-face. That knowledge is translated to a ‘risk score’ that accurately predicts future loss ratios, and can be used across the organization, from marketing to acquisition to policy management and claims. It has not yet impacted our pricing sophistication, but that day will come – just like credit history did and auto telematics may soon.”

Whether you are a competitor or not, you simply cannot ignore this. The tectonic plates are shifting and you need to put yourself on stable ground.

For all the hype, Lemonade still has less than 0.1% of the Home and Renters insurance market, compared with 19% for State Farm and 10% for Allstate to keep things in perspective.

However, Lemonade’s loss ratio focus, customer-centric attitude, innovative (though unproven) business model, and technology-first approach will continue to draw the attention of traditional carriers.

Regardless, they not only need to improve their AI models and infrastructure but need to execute their plan to expand to new products and geographies.

And the challenges don’t stop there…as they expand geographies and things like Hurricanes and natural disasters occur, will their bots be able to handle these complex claims? The jury is still out, and we wonder if Lemonade’s loss ratio will sustain its pace of improvement as these factors continue to evolve.

Yes, they’re collecting lots and lots of data, but their customer base is tiny compared to their competitors so only time will tell.

And every question that lingers about Lemonade’s business model is an opportunity for traditional carriers to dive in.

Want to be more like Lemonade?

Where Lemonade has gotten things especially right is its digital-first approach to understanding its customers.

If 90%+ of communication is non-verbal (body language/tone), companies that shift their operations entirely online are blind to nearly all of the customer behavior they were able to observe before.

They are stuck using static forms and applications that provide the “final answer data” from roughly 10-40 questions/form fields. That means they are making their most important decisions such as underwriting, pricing risk, and paying out claims with very limited data.

With a Behavioral Intelligence solution like ForMotiv’s sitting behind the form, you can collect over 100x on every application, instantly.

So should carriers simply copy Lemonade’s behavioral analytics strategy, collect this behavioral and outcome data themselves, and catch up? We firmly believe the answer is yes. (But don’t just take our word for it)

Having said that, even with departments aligned at a traditional carrier, it still could take months to get through all the red tape and then months/years to physically build and maintain such a technological system.

Lucky for you, we’ve been building ForMotiv to be an out-of-the-box “behavior-as-a-service” tool for years so you don’t have to.

With a few lines of code, our Behavioral Intelligence solution will instantly collect thousands of behavioral data points we call “digital body language” as users engage with forms and applications.

Rather than attempt to build a complex behavioral analytics solution yourself, we give you the ability to get into the behavioral analytics game arena instantly.

“Simply put, if you need of a gallon of milk you’d go to the grocery store, you wouldn’t raise a cow,” says Woody Klemmer, Head of Growth at ForMotiv

We discuss the Build vs. Buy argument in-depth in our newly published EBOOK.

This allows for a far greater understanding of customers and their behaviors leading to greater user experiences and far more effective risk assessments, fraud detection, and policy pricing.

And the best part is, carriers are currently sitting on top of oil fields worth of behavioral data, they just need the right rig to drill it.

ForMotiv collects and analyzes over 150+ curated behavioral features such as hesitation, frustration, confusion, corrections, and hundreds of digital behaviors which results in tens of thousands of behavioral micro-expressions on each individual application.

This high-definition view of an applicant gives you the insight needed to predict intent instantly and accurately.

As Dr. Robin Kiera, Insurance Influencer and Founder of Digitalscouting.de, said…

“Lemonade Inc. improves existing processes in an amazing way but does not reach a different level. In fact, traditional insurers could catch up by investing wisely in agile, proactive, visionary, and hands-on digitalization units, independent of their old corporate core,” says Dr. Robin Kiera.

He continues, “In the long term, this could trigger a discussion about the core role of the combined ratio in the current insurance model. Large insurance carriers may need to change their product lines, and refrain from using a positive combined ratio to boost their profitability because customer behavior and customer demands change. This would put tremendous pressure on the other pillars of profitability: the efficiency of internal processes and the sales channels. Considering the maturity of most insurance markets in the Western world, the loss of profitability probably could not be compensated for with moderate restructuring or uplift of sales, perhaps causing distress in some industry sectors. As Victor Hugo once said, “Nothing is stronger than an idea whose time has come.”

The benefits of adopting a Behavioral Intelligence strategy today and watching the value of the dataset compound will pay massive dividends in the future.

The use cases are endless but a few of the most powerful to date are enabling automated underwriting/claims, predicting customer intent such as risk or fraud, form and application analysis for user experience optimizations, and understanding agent behavior for both workflow enhancements and risk/fraud mitigation.

So, we’ll leave you with this question…do you think data-enhanced, tech-enabled insurers, with customer-centric business practices, are a fad or do you think they’re the future?

Either way, behavioral analytics will impact both legacy insurers and InsurTechs.

P.S. If you’re interested in learning about the evolution of behavioral analytics and the future of behavioral intelligence, download our Free EBOOK.